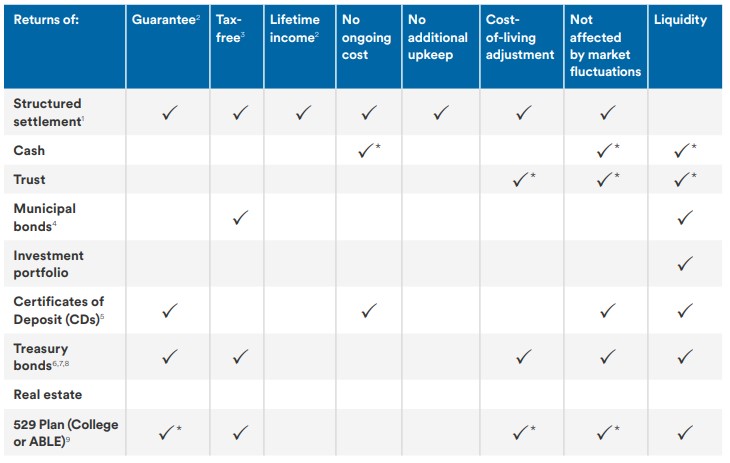

In a recent release, Met Life’s Retirement and Income Solutions group compare the value of structured settlements to other income-producing / retirement income investment products. The results are quite compelling and worth re-broadcasting.

While structured settlements do not provide every answer or meet every investor’s needs, it’s also clear that structures should be a critical part of any retirement and lifetime income plan. As Met Life’s simple, elegant graph details, structures blend more invaluable features than any other investment vehicle in the market.

As you can see above, the differentiators are significant and meaningful. In retirement planning, securing lifelong, guaranteed, COLA-adjusted, tax-free income without any additional costs, upkeep, or market risk is mission-critical. Structures are the only investments available that provide all of these benefits.

While liquidity may be considered a drawback with structures—the only miss in eight categories—the tradeoff is the stability and security ongoing payments can provide. Investors can address the need for liquidity with a balanced strategy that includes one or a mix of other investment options. Structures are invaluable in recasting the value of a salary or a pension: financing a budget you can count on to meet the day-to-expenses no matter what happens in the economy, in your choice of investments, or the Stock Market as a whole. Structures are security perfected.

Structures are not only the “greatest gift the IRS provided to injured individuals” but also the “goose and its golden eggs” that every strong retirement—or post-injury plan without steady income–requires. Even if you are young, additional time adds additional value for the structure’s retirement payout, and allocating some of your settlement to a structure will provide peace-of-mind now and for all the years to come.

As you resolve your personal injury settlement, taking a minute to weigh the unique opportunity a structure provides is essential to getting it right. Once the money changes hands in a settlement, guarantees diminish, and tax-free income disappears.

Because everyone and their circumstance are unique, we are here to help assess each claim, customize a plan, and maximize the value of the settlement. We can couple that secure income with savings on a wide variety of common post-settlement medical costs with our free, innovative, chronovo.care program too.

You can reach us at 781 336 4680 or info@chronovo.com or visit Chronovo.com for more information