TWO WAYS TO CREATE A REVERSIONARY REFUND IN YOUR NEXT MSA WITH STRUCTURES

Another consequence of CMS’ newly-published presumption against evidence-based MSAs [See our “Meteor” article] is a review of reversionary refund options. Returning the unused portion of an MSA to the carrier or self-insured after the death of a claimant makes good, logical sense. After all, MSAs are required by CMS to protect the Medicare Trust Fund, not to fund a claimant’s estate after death.

Either to mitigate doubtful life expectancy, reduce overpriced or unused allocation costs, or hedge against unexpected death, reversionary refunds create MSA savings that are CMS approved and do not reduce the claimant’s medical benefits. As a result, they can significantly lower the cost of MSAs and CMS compliance for your claims organization.

WHAT ARE THE OPTIONS?

There are two options to create a reversionary refund on an MSA upon the death of the claimant. Along with all the other value created by structuring MSAs [See our “Blues” article], one refund option is enhanced by a structure; the other option is impossible without one.

- Reversionary Interest on a Professionally-Administered MSA Account. While a lump sum is still possible, funding an MSA account with a temporary life structured settlement annuity maximizes the upfront savings (an average of 30%+) of the cost of the MSA. If the MSA is professionally administered, the insured/carrier can create a reversionary interest in which the remaining funds in that account are returned to the payor upon the death of the claimant. The account is initially seeded with a cash lump sum, and fed each year with annuity payments which cease upon the death of the claimant.

- Reversionary Rider with the Employer/Carrier as the Beneficiary. The annual MSA payments can also be funded with a period certain or guaranteed annuity instead with a commutation or reversionary rider. In this scenario, any remaining guaranteed annuity payments will be commuted and paid in a single lump sum to the employer or insurance carrier after the death of the claimant. The reversionary refund is contained within the policy itself as a rider and typically returns 95% of the remaining value. The carrier or self-insured is just like a beneficiary in a life insurance policy.

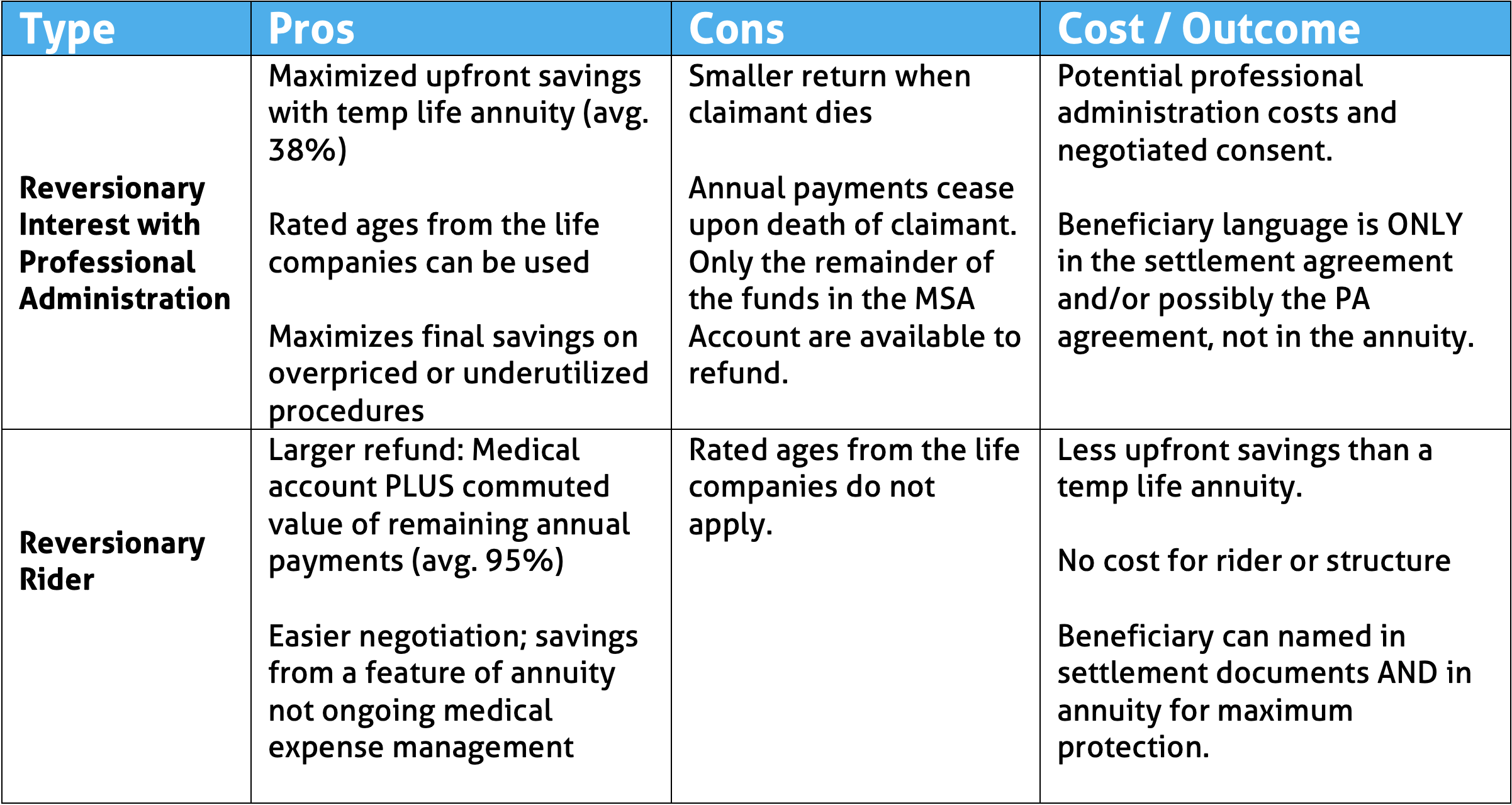

A summary of the value of both approaches is as follows:

OTHER CONSIDERATIONS

Because a Reversionary Interest in a professionally-administered MSA requires claimant’s consent for the professional administrator to monitor and approve all MSA spending post settlement and a Reversionary Rider does not, the Rider option may be easier to negotiate.

Even though it is contrary to why MSAs exist, if claimant’s counsel wants to use remaining MSA dollars to fund the estate, either the Interest or Rider option can be subject to a pre-defined percentage split between the carrier/self-insured and the claimant’s estate.

With structures critical to both options, we are well-versed on the strategies and the options. We welcome your inquiries and our services are free! Please contact us: Paul Rogers at progers@chronovo.com or (610) 724-4320 or any other Chronovo colleague for more ideas and details.